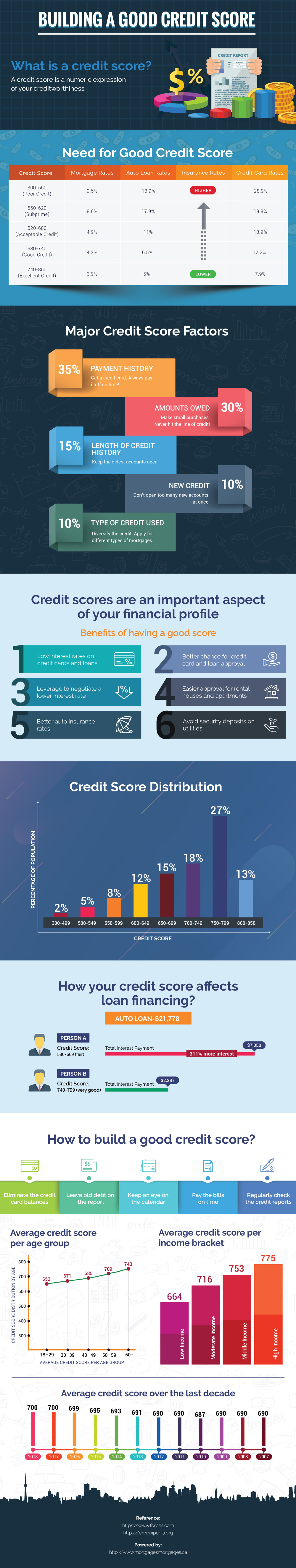

A credit score is a number that represents your overall credit health. Your credit score is something you probably don’t think about very often. It’s only when applying for a new apartment, a loan, a mortgage or any other major expense that the topic of credit score comes up.

IMAGE: PEXELS

Is a Good Credit Score Important?

At that moment, your credit score means a great deal. Having a high credit score will make you an ideal candidate when it comes to securing a mortgage, loan or insurance policy. Its worth dollars and sense to maintain that credit score! If you have a good credit score you can be confident you’ll secure the loan, mortgage or apartment.

If you have a poor credit score it will be trickier to secure those things. You may also be given an unfavorable interest rate. If you want to save money and improve your credit score, read on to get all the information.

The credit score is a numeric representation of your creditworthiness. If you pay your bills on time, avoid opening too many credit cards at once and maintain your old accounts, your credit score should be good.

Source: Mortgages Mortgages

Events like bankruptcy, or having chronic debt will negatively affect your credit score. A good credit score puts you in an advantageous position when negotiating loans, approval for a new residence or securing auto insurance.

What Is A Credit Score?

A credit score is a numeric expression of your creditworthiness. It takes into consideration factors like how often you pay your bills, your track record of paying off items in full and whether you’ve been bankrupt. A low credit score can make it difficult to move forward in life.

Loan officers may issue a higher interest rate on a loan given to a person with bad credit. This resultes in much higher interest payments. Canadian credit scores are officially calculated by two major credit bureaus: Equifax and TransUnion. They use the information in your credit file to calculate your scores. Factors that are used to calculate your scores include your payment history. They also look at how much debt you have and how long you’ve been using credit.

Avoid opening several new credit card accounts at once. Keep your old accounts open so you can display a long track record of financial responsibility. Credit scores are extremely important when you want to make big life changes.

The distribution of population versus credit score is widely dispersed, so it’s important to know where you stand. People are becoming more empowered to manage their finances. Your credit score plays an instrumental role in securing a loan, mortgage, a new place to live or a good rate on your insurance policies.

It’s a nice feeling to apply for a mortgage and have it be approved without a question, due to your good credit score. Keep your credit scores as healthy as possible by reviewing your credit reports regularly to ensure they are accurate!

If you are interested in even more business-related articles and information from us here at Makeup By Kili, then we have a lot to choose from.

COMMENTS